Turn compliance into verified carbon impact in days, not years.

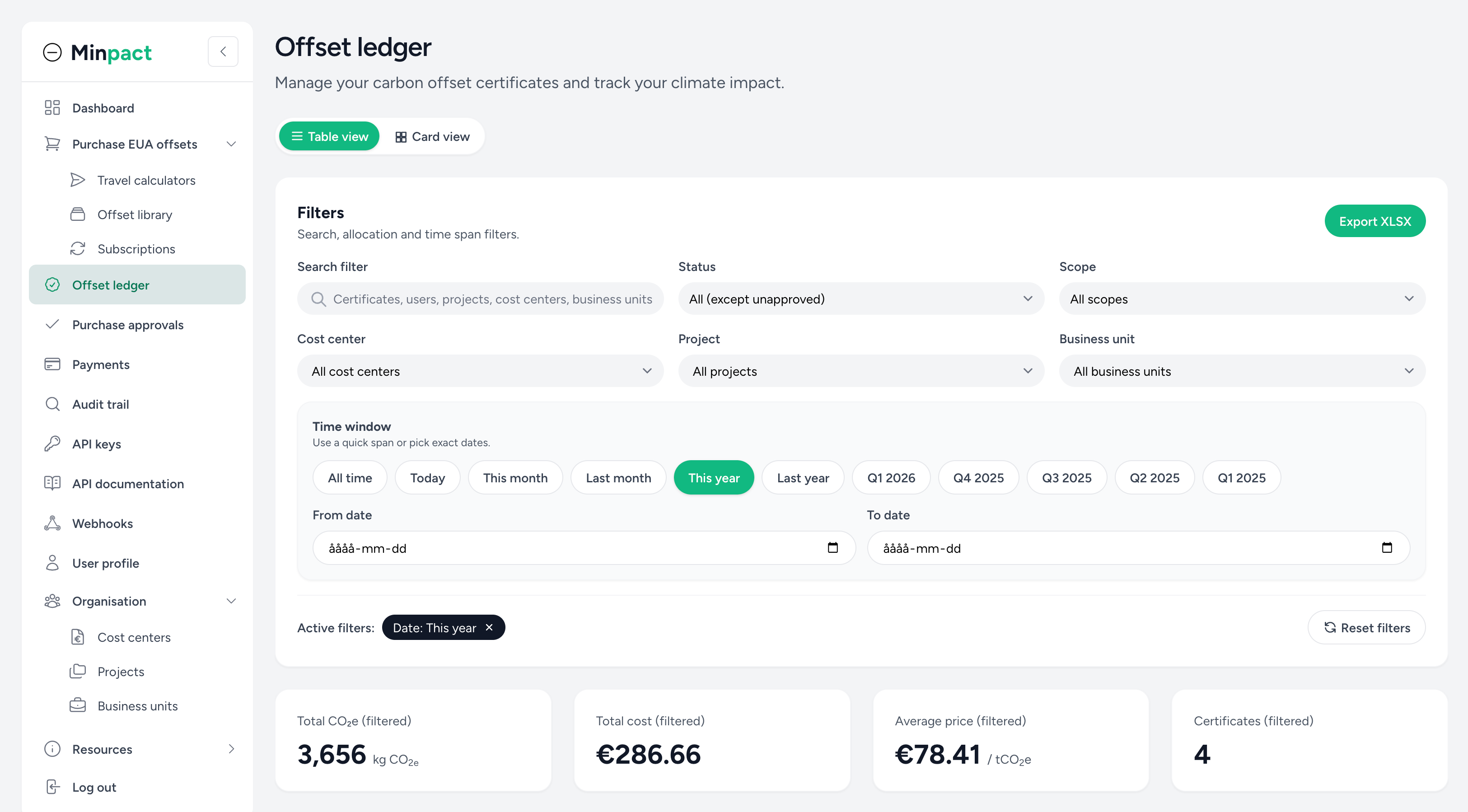

Minpact cuts emissions at the source and gives you audit-ready, regulator-aligned climate impact without project risk or greenwashing. With Minpact Offset Ledger, enterprises connect EUA deletion directly to their finance and sustainability workflows.

Remove the right to pollute. Permanent. Verified. Fast.

See how EUA deletion converts directly into permanent emission reductions for your portfolio.

Min

Min